1. Introduction

The first Roth IRAs were opened in 1998 due to the Taxpayer Relief Act of 1997. This Act is arguably one of the greatest gifts Congress has ever given the American Taxpayer.

What is a Roth IRA (R-IRA)?

A Roth IRA is simply an after-tax individual retirement arrangement (IRA) that grows tax-free - giving the taxpayer the opportunity to pay their taxes upfront and owe nothing later.

What is a Traditional IRA (T-IRA)?

A Traditional IRA is a way to utilize tax-deferred income that grows - giving the taxpayer savings on taxes upfront but will owe them later - and trust me - Uncle Sam always collects his debts.

2. Tax Difference Between R-IRA / T-IRA

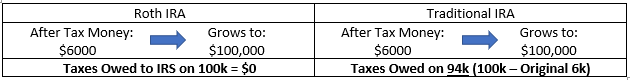

Say you max out your Roth IRA one year at $6000 and it grows to $100,000. When you turn 59 and 1/2 years old, that $100,000 is all yours - nothing more needs to go to Uncle Sam.

Now say you max out a traditional IRA one year at $6000 and it grows to $100,000. If your original $6000 contribution was after-tax money then you owe income level taxes (based on tax bracket system) on $94,000 ($100,000 minus $6,000). If however your $6000 was pre-tax money then you owe income level taxes on the whole $100,000 the account grew to.

3. The “Backdoor” Method

“But I make too much money to save into a Roth IRA” is something I hear all the time. The fact is yes on the surface if you make a modified adjusted gross income greater than $139,000 for single-filers or $208,000 if married and filing jointly (for the year 2021), then you cannot contribute directly to a Roth IRA. But if you delve deeper you will see that original statement is false- you actually can contribute to a Roth IRA through the “backdoor” Roth IRA method. Since there is no income limit to contribute money to a traditional IRA one simply needs to contribute USD to a T-IRA up to $6000 (for 2021) and then convert their traditional IRA to a Roth IRA.

If you meet Income Requirements:

Bank → Roth IRA

If you do not meet Income Requirements:

Bank → Traditional IRA → Roth IRA

Let’s say, as a single-filer, you made a modified adjusted gross income (MAGI) of $150,000 for the year 2021. Given that you made over $139,000 MAGI you cannot contribute directly to a Roth IRA. Therefore, you instead open up a Traditional IRA and decide to contribute $6000 and max out that year’s contribution limit. If the $6000 is used as pre-tax money, when you convert it, you will pay income tax on whatever amount you convert to Roth IRA. If the $6000 you contributed to the T-IRA is after-tax money, then only the earnings your contribution made, is taxed as income upon the conversion. An example is as follows: In January 2021 you contributed $6000 after tax dollars to a T-IRA for the 2021 tax year. In December, you check your account and it is now worth $6100 and you decide to convert your T-IRA to a Roth IRA. This will result in you paying income taxes on the $100 earned in your account. Therefore, it is best to convert your T-IRAs to R-IRAs sooner than later if you are using the backdoor method to save even more on taxes.

4. Required Minimum Distributions

Required Minimum Distributions (RMDs) are not required for Roth IRAs, but are required for Traditional IRAs after age 72 (for 2021 - this age may increase depending on laws passed by Congress).

5. Who qualifies to contribute to a Roth IRA/Can I open one up for my kids?

You need to have reported taxable income for the year you want to contribute directly to a Roth IRA that is also less than the MAGI limits discussed above. If you only make $4000 USD from a summer job and file taxes you can contribute only up to the amount you made that tax year ($4000 USD) even though the IRA contribution limit is $6000 USD. This particular topic is for people asking if they can open up a Roth IRA for their children (simple answer is yes only if they have earned income and file taxes).

6. Withdrawing from your Roth IRA:

You can take out what you put in (contributions) penalty-free, but the earnings your contributions make are untouchable unless you pay a 10% early withdrawal penalty and income level taxes (for Roth IRA).

To withdraw your earnings (not contributions) you must have had a Roth IRA for at least five years (open one sooner than later to meet your five year requirement!) and meet one of the following: you’re 59 and 1/2 years old, disabled, deceased (your estate withdraws your funds), or using the money up to $10,000 for a first-time home purchase.

7. What to watch out for:

New tax laws: Congress will potentially try to get rid of the backdoor conversions either for everyone or for high-income earners in 2022 (we won’t know until something is passed).

Pro-Rata Rule: If you have a Traditional IRA or multiple Traditional IRAs and rollover IRAs with a mixture of pre-tax and post-tax money, it becomes a ratio of how much tax you owe when you convert from T-IRAs or rollover IRAs to a Roth IRA. An example: if you have two traditional IRAs, one with $5000 of after-tax money and the other one with $10000 of pre-tax money and you decide to convert $5000 to a Roth IRA you will have to use the Pro-Rata Rule to determine how much income tax you owe. You cannot say the $5000 converted is only the after tax money in your one account, all accounts must be added together before you convert. So if you convert $5000 you will owe income level taxes on two-thirds (2/3) of it - which amounts to income level taxes on $3,333.33 (2/3 times 5000 = 3,333.33). This fraction is found from the use of proportions as follows: $10,000/$15,000 or pre-tax money divided by total worth of pre-tax IRA (Rollover, SEP, Simple, Traditional IRAs) accounts.

Important to note: Conversions of rollover IRAs or Traditional IRAs do not count towards the contribution limit per year ($6000 contribution limit for year 2021). There is no limit on how much money you convert. If you have $200k pre-tax money in a rollover IRA you can convert any amount up to the $200k in a given year to a Roth IRA (just be aware of how much income tax you’ll owe on the conversion).

You cannot contribute 6k to both a traditional and Roth IRA in the same year. The 6k limit (year 2021) is cumulative between both the traditional and Roth IRAs. For example, you can legally contribute 3k to a traditional and another 3k to a Roth IRA (3k + 3k = 6k). You cannot contribute 6k to a traditional and 6k to a Roth (6k + 6k = 12k contributed- which is over the 6k contribution limit).

Retire By Investing is on a mission to help others increase their free time through financial education. This substack does not provide financial advice of any kind. We do not sell or manage financial investments or vehicles. We are not licensed individuals and are not liable for any financial decisions you make. Please do your own due diligence and consult/seek your financial advisor regarding any decisions. Thank you. Have a great day!

Join us on our journey to help others by subscribing below!

If you liked this post from Retire By Investing, why not share it?

Thumbnail Pictures Provided By These Artists on Pexels.

Share this post