We have an articles section filled with free financial education. Click here to gain access

Introduction

Home ownership allows one to have access to certain tax benefits. If you’re thinking that a house can lower your tax bill to some extent – you’re right. Home ownership not only gives you a tax deduction, but it also gives the average investor a way to utilize equity to cover a hefty tax bill rather than being forced to sell off investments. Massive wealth can be accumulated if an investor understands the creativity behind taxes and investment vehicles. In this article you will learn how we snowball our gains and pay minimal taxes. Oh yeah – all of this is legal.

Building equity in the house is a priority

After two to three years of home ownership – two things may have happened: 1) appreciation of the home value and 2) built-up equity from making payments. Huge opportunities open up once your home value appreciates and you have built up equity. In fact, you can use this equity to cover you tax bill (this will be discussed below). Having built up equity allows the investor to choose whether they want to temporarily take money from their Home Equity Line of Credit (HELOC) or sell off investments to cover their tax bill.

The difference between long term and short term capital gains

There’s a striking difference between long term capital gains (LTCG) and short term capital gains (STCG) in how they are taxed. Long term capital gains is taxed up to 20%, depending on your Modified Adjusted Gross Income (MAGI). LTCG is any security of commodity that is held for more than 366 days and then sold. Short term capital gains, on the other hand, is added on top of your taxable income and can heavily increase your tax bill. STCG can be taxed up to 37% (yes, 37%!!!). STCG is anything held and then sold at 365 days or less.

Loaning against the house to pay taxes

It is important to note that tax bills can be extremely high, and as a result, you may not have the cash on hand to cover the bill. So the predicament is 1) to sell off investments and pay either STCG or LTCG the following year vs. 2) to utilize the equity you’ve built up in your home to pay your tax bill. You can utilize the equity you’ve built up through a Home Equity Line of Credit (HELOC) and using the HELOC money to pay off a high tax bill. This money isn’t free - there’s interest tacked on that you must pay per month, but it could turn out to be significantly less in the long run.

In other words, leveraging your home can allow you to pay off your current tax bill while also allowing you to prolong the sale of your investments as STCG. The goal is to get your investments to the point where they qualify as LTCG rather than STCG. Utilizing the HELOC money to pay your current tax bill can buy you the time you need. Allowing investments to qualify for LTCG can keep next year’s tax bill lower than if you had sold the investments as STCG. If you have a strong investment thesis – you can create a rolling LTCG year over year if you dollar cost average into a certain stock for a long period of time. Each year, if you’re investing in one particular stock or index, you’ll be able to sell off a portion and keep rolling your long term capital gains via FIFO (Research FIFO: First in First Out Accounting). Once the snow ball happens, you will be able to keep a fairly low tax bill (through LTCG) in comparison to those who are consistently selling off their assets as STCG to cover their taxes year after year.

In the next section you will the difference in a hypothetical tax bill.

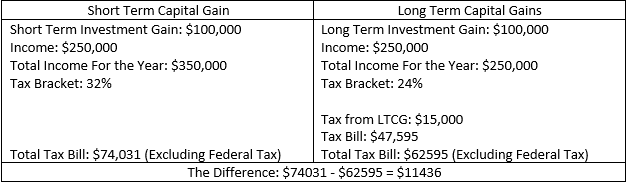

The tax bill comparison between LTCG and STCG

Hypothetical Filing Married Filing Joint making 250k

Hypothetical Filing Single making 250k

Affiliations

Our Crypto Custodian.

BlockFi - was created to provide credit services to markets with limited access to simple financial products. BlockFi sets itself apart from other crypto service providers by pairing competitive rates with institutional-quality benefits. BlockFi is the only independent lender with institutional backing from investors that include Valar Ventures, Galaxy Digital, Fidelity, Akuna Capital, SoFi, and Coinbase Ventures.

NFT Partner

Essential Workers - There’s no substitute for appreciation and gratitude to all the heroes that put their lives on the line to serve the public. See every profession in unique backgrounds, clothing, accessories, and events. Collect your professions while they’re available. We celebrate you and your hard work. Have your livelihood minted.

Click Here For More Information!

Retire By Investing is on a mission to help others increase their free time through financial education. This substack does not provide financial advice of any kind. We do not sell or manage financial investments or vehicles. We are not licensed individuals and are not liable for any financial decisions you make. Please do your own due diligence and consult/seek your financial advisor regarding any decisions. Thank you. Have a great day!

Join us on our journey to help others by subscribing below!

If you liked this post from Retire By Investing, why not share it?

Thumbnail Pictures Provided By These Artists on Pexels.

Share this post