1.Introduction.

What is a Brokerage Account?

It is an arrangement where an investor deposits money with a licensed brokerage firm. This firm places trades on behalf of the customer.

What are the tax implications of selling investments in a Brokerage Account?

When the customer sells an investment, they will need to pay either short term capital gains (income level taxes, see tax brackets - up to 39.6%) or long term capital gains (ranging from 0% to 20% based on taxable income). Capital gains is any profit your original investment has earned. Long term capital gains is any sale that is 366 days or more after the date of the original purchase, any sale that is 365 days or less is considered short-term capital gains.

2. So why make my children beneficiaries instead of the primary account owner?

Reason #1: Step-up Basis

Say the brokerage account owner dies and has listed beneficiaries to inherit the account upon their death. Their beneficiaries will inherit the account and get step-up basis. Step-up basis is when the assets received by the beneficiaries are “stepped-up” to its current market value, tax-free. For example, if the original owner of the account bought Apple Stock for $10 USD/share over a year ago and upon their death Apple Stock is now trading for $170 USD/share, then, the new “stepped-up” cost basis for the beneficiary will be considered at $170 USD/share. What this means is if the beneficiaries sell their Apple inheritance for $170 USD/share they owe zero taxes. If, however, they sell Apple for $180 USD/share then they will owe long term capital gains taxes on only the $10 USD gain/share (because the original purchase was 366 days or more ago).

2) Avoiding Probate Court

Let’s take the above example and say the original brokerage account owner did not have any listed beneficiaries. Then that account’s assets will have to go through probate court (if account is worth more than $150k). You can research more about probate court, but it is essentially a long and grueling process (1-2 years) that takes unnecessary money away from the inheritance (for CA: 4% of the first 100k, 3% of the next 100k, and 2% of the next 800k plus attorney fees). That is why it is extremely important to have your beneficiaries listed on all of your accounts.

Now compare this to if your children were the primary account owner. You will see that there would be no stepped-up basis and they would owe long term capital gains tax on the Apple Stock originally purchased for $10 USD/share. If they were to sell the Apple Stock at $170 USD/share they would owe at most 20% long term capital gains tax on $160 dollar profit/share ($170 minus $10 = $160).

Important Info: Say before the account owner died they gifted their beneficiary all of their apple stock. This would not receive “stepped-up” basis and the original cost basis for the Apple Stock would remain at $10 USD/share.

Food for thought: One could gift up to 15k a year (as of 2021) to their parent (or other entrusted family member). Their parent invests that money into a brokerage account they own with the person who supplied the 15k gift as a beneficiary. When that money is inherited in the future, the investments will get a step-up in cost basis.

3. Additional information

Consider setting up a Revocable Trust as the primary account owner. Revocable Trusts can make it much easier to manage your estate upon your death and ensure your assets do not end up going through probate court.

Watch for new tax laws. Congress may try to end step-up basis in the future.

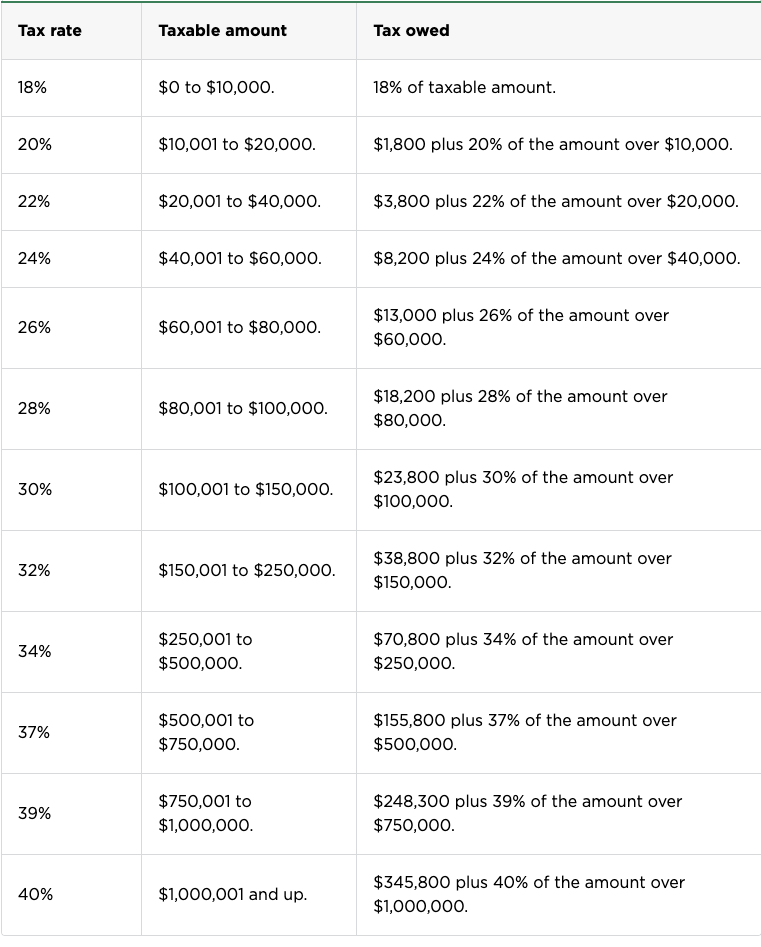

Make sure to understand estate taxes upon inheritance. Federal estate taxes kick-in on anything over 11.7 million (for 2021) and 12.06 million (for 2022) ranging from 18%-40% (depending on how much over the threshold your estate is). Some states also have estate taxes (California does not!) You would need to compare the burden of estate taxes (brokerage account with beneficiaries) vs. gifting the assets (as discussed above) and make a decision on which strategy is better for you (which results in fewer taxes).

Retire By Investing is on a mission to help others increase their free time through financial education. This substack does not provide financial advice of any kind. We do not sell or manage financial investments or vehicles. We are not licensed individuals and are not liable for any financial decisions you make. Please do your own due diligence and consult/seek your financial advisor regarding any decisions. Thank you. Have a great day!

Join us on our journey to help others by subscribing below!

If you liked this post from Retire By Investing, why not share it?

Thumbnail Pictures Provided By These Artists on Pexels.

Share this post