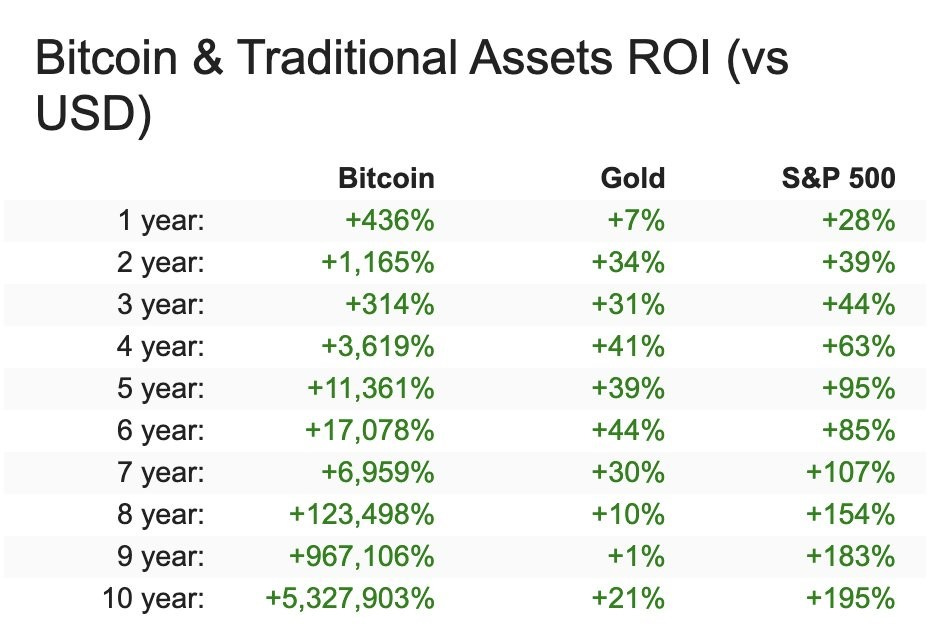

Bitcoin is the apex asset class that is a true hedge against inflation. Bitcoin, known as being a cryptocurrency, has been labeled as an asset class after reaching a market capitalization of more than one trillion dollars. Bitcoin has been the leader for the past decade with a compounded annual growth rate (CAGR) greater than 150% when compared to all other asset classes. There has been no other asset class that has produced such a return in a small amount of time. Fundamentally, Bitcoin has a fixed supply cap of 21 million Bitcoin, making it one of the the most scarce resources known to man. Other asset classes, when compared to Bitcoin, do not have this characteristic of having a hard fixed supply cap.

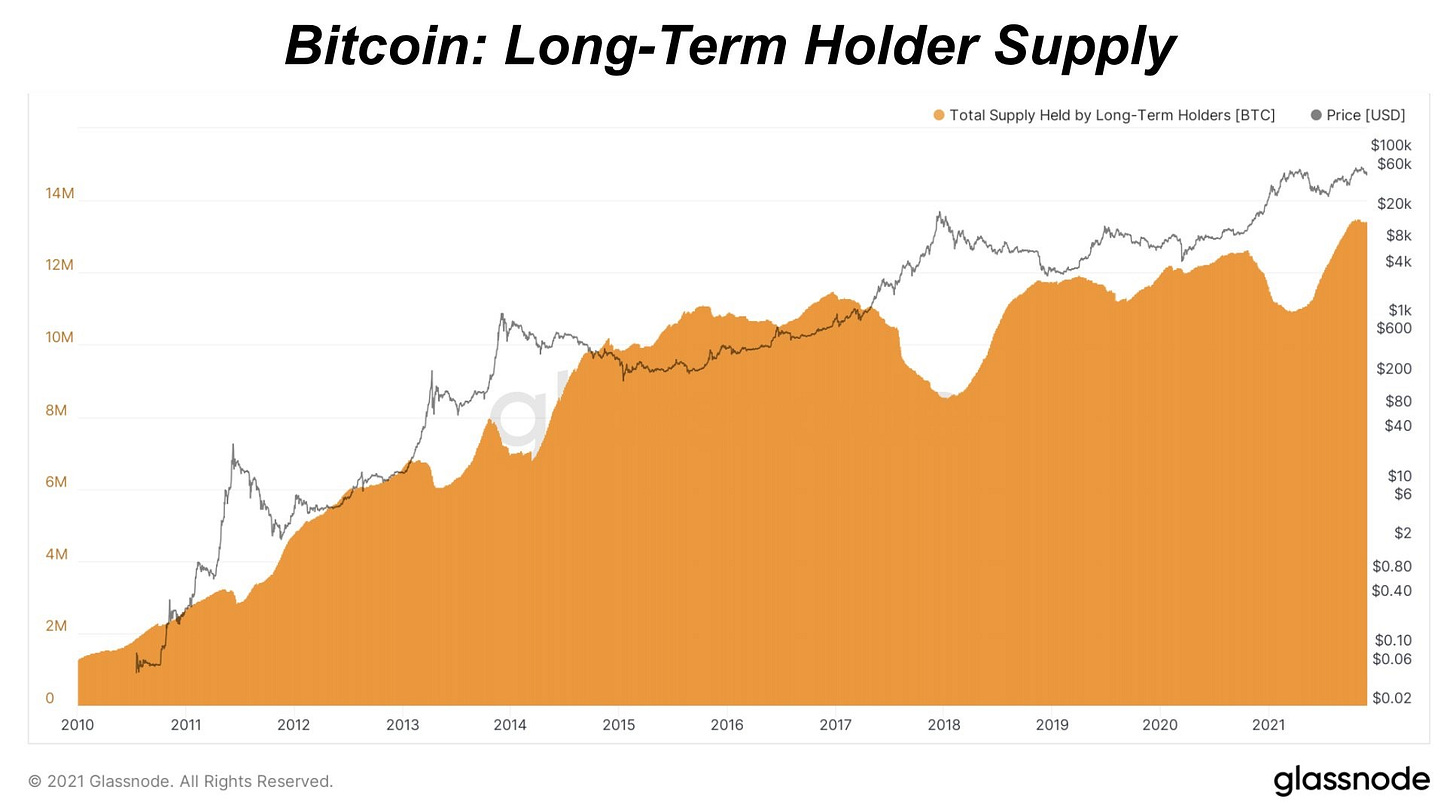

Long term holders (Orange) has increased to an all time high (at the time of this writing), while price is slowly increasing back to Bitcoin’s all time high price.

Out of the total 21 million Bitcoin, there are roughly 18 million Bitcoin that have already been mined and 3 million Bitcoin left to be mined over the next 119 years. It is estimated that 16 million of the 18 million Bitcoin can no longer be purchased, leaving around 2 million Bitcoin on exchanges for the world to purchase. If you take the global population of 8 billion people and divide that by the sum of the remaining 2 million Bitcoin left on exchanges and 3 million to be mined over 119 years – you quickly realize that not everyone can own a full Bitcoin. Every 4 years, the amount of Bitcoin that comes onto the market (mined per day) is lessened (halvening cycles per Bitcoin protocol), which makes it harder for people to mine or obtain Bitcoin. Since the amount of Bitcoin lessens, the supply is constrained, which will increase the demand for this asset over time.

Bitcoin’s fixed supply cap is attractive to many investors because it automatically adjusts for inflation. Inflation is a hidden tax that only gets worse as the government injects more and more money into the economy. Many do not realize how much inflation eats into their purchasing power of everyday costs. The Consumer Price Index (CPI) of October is said to be 6.2 percent inflation – the highest it’s been in 30 years. CPI is a metric that does not include food, energy (gas), or rent – which is important to any human. Since CPI does not include all data for inflation, the number is actually higher than what is stated. The majority of larger cities over the last five years have experienced an inflation rate of 12% (If you haven’t read our other article – please do so here), but that was before COVID. With COVID and the increase in monetary supply, inflation is way over 15%. Housing prices for 2021 have risen 18% - meaning, if you were holding USD (fiat) then your money has depreciated by the same amount.

Bitcoin is potentially a great investment over a longer timeframe. Over a shorter timeframe, Bitcoin can chop up many investors who try to take profits early. Those that have held for more than 4 years have received asymmetrical returns on their capital. Four years may seem like a long time, but in the investment world that is very short. Investors do not need to put in a large portion of their net worth to obtain a great return. Many have put in less than 5% of their net worth and have grown that into astronomical amounts due to Bitcoin’s programmed asset scarcity.

The macro backdrop of the global economy is accelerating the cryptocurrency trend. The massive amounts of quantitative easing we have witnessed is a powerful driving force for Bitcoin, along with other asset classes, to adjust accordingly to accommodate for inflation. Gold, which has historically been used as an inflation hedge, has performed poorly when compared to Bitcoin. It can be argued that Gold (when compared to Bitcoin) is harder to use as a currency (means of exchange), experiences more inflation as Gold is mined every year (not a true fixed supply), and can be confiscated more easily. The current market cap of Gold is around ten trillion dollars while that of Bitcoin is only 1 trillion. If Bitcoin succeeds in taking over Gold as a store of value, then Bitcoin’s market capitalization will go from one trillion to ten trillion dollars. At a ten trillion dollar market cap, each Bitcoin will be worth more than $500,000 USD per coin. Bitcoin also has the potential to become a peer-to-peer monetary network that will provide a way to pay for good and services. Simply put, Bitcoin’s worst case scenario is that it replaces Gold as a store of value.

Some of the wealthiest people have started to invest in Bitcoin on a personal and institutional level. Jack Dorsey (Square), Elon Musk (Tesla), Michael Saylor (Microstrategy), Cathie Wood (Ark Invest), and Tim Cook (personal only) (Apple has not publicly announced BTC purchase to date) have exposure to Bitcoin. This begs the question why some of the greatest minds are beginning to invest in Bitcoin. Bitcoin is not just for the wealthy - politicians and athletes are now starting to collect their salaries in Bitcoin.

The question is not why are they adding Bitcoin to their portfolios – the question is why aren’t you?

Disclaimer: Retire By Investing holds a position in Bitcoin as a treasury asset. Please seek a financial advisor. This content is intended to introduce the thought of adding Bitcoin to your portfolio, but it is not financial advice. Please seek a licensed professional for your financial decisions.

Retire By Investing is on a mission to help others increase their free time through financial education. This substack does not provide financial advice of any kind. We do not sell or manage financial investments or vehicles. We are not licensed individuals and are not liable for any financial decisions you make. Please do your own due diligence and consult/seek your financial advisor regarding any decisions. Thank you. Have a great day!

Join us on our journey to help others by subscribing below!

If you liked this post from Retire By Investing, why not share it?

Thumbnail Pictures Provided By These Artists on Pexels.

Share this post