You’re losing money and you don’t even know it.

Disclaimer: This article contains my own experience with the market and all of the research I’ve done. I’m not adding in any links because I believe if you want to become financially free – you will have to work for it.

Majority of the healthcare workers are not making enough to support themselves in the bay area. Six figure incomes may seem like an amazing accomplishment in other areas of the nation, but not in the bay. What people fail to realize is that they’re consistently losing money – there’s no amount of overtime that will outpace the biggest wealth killers: inflation and taxes.

For anyone living in the bay area, it’s very easy to fall prey to the “shiny object” syndrome. Anyone who has never made any significant amount of money will want to show case themselves to the world. This is how people lose out on many financial opportunities because they’re focused on how they’re perceived rather than what their future brings. People always say “I’m waiting for the market to crash and then I’ll buy”. Unfortunately, this is not how the markets work. The market is not the economy, and markets don’t always go on discount.

Below is a picture of the S&P500 – A stock market index.

Please ask yourself when you would have bought. After you figure that out, look at your investments and point out where you actually did buy. If you never bought, ask yourself when was a great time to buy. And based on that, did you actually buy? If you didn’t, you must reflect now.

(TC2000 Stock Chart)

If someone said, I’m waiting for the market to crash, they would still be waiting even after 13 years. In the investment world, 13 years is an amazing stretch to grow your money. Anyone building a college fund in a 529 Plan, would miss out by waiting for the market to crash. Anyone waiting on the sidelines would be missing out on ways to grow their money, and that is why people, who never start, will never start.

Investing is not only monetary – it is psychological and emotional. People who fail to understand what risk is will never risk any money in the markets. There are people who fail to understand that playing the market is all about experience. If you do not have experience, don’t expect your results to be breath taking. Highly intellectual people do not have the temperament to invest because they rationalize with emotion. Instead of staying calm and collected – they are in it for quick gains and short time frames that only serve today and tomorrow. However, investing is not a day or a swing trade – it is a lifetime understanding of the markets and how you allocate capital and grow it.

In the short term it is always risky to be in the markets; however, it is also very risky to not be in the markets long term. There’s an old saying that goes “time in the market > timing the market”. This is because dollar cost averaging has been the best overall strategy over the long term. Look at any stock market index or any housing chart and you will have your answer. In the longer period, asset prices only go up.

Now let’s get down to the nitty gritty of things.

Let’s be generous and say the bank gives you 0.1 percent (I know they give .001,but let’s be nice). Let’s say you get a 4 percent raise every single year to your hourly pay, which would seem like a great raise, but in reality it’s not. Based on today’s standards - let’s say inflation is 8 percent. Consumer Price Index says 5 percent inflation, but that’s not real. The reason why it isn’t real is because Consumer Price Index is not factoring inflation costs in rent, food, and gas. If you DO NOT need a roof over your head, eat a meal, or drive to work, then CPI is definitely accurate, but for the majority of America that is absurd. So this brings you to the final numbers that you’re losing money at a -3.99%. What you may think is that “oh -3.99% isn’t that bad”. However, that’s a nationwide number – here’s what It was in the last 5 years.

(Chapwood Index)

San Jose is literally growing at an inflation rate of 12.9%. This year’s hourly raise is literally not enough for you to live. 2021 is worse than 2020, but based on these numbers you are at a negative 8.8% if you leave your money in the bank. Anyone losing 8.8% percent of their money on a yearly basis will not be able to buy a home. You won’t be able keep up with everyone who is growing their money without having to work more. You would have to work more OT to account for that 8.8 percent and then you would have to factor…. Taxes. Whatever tax bracket you’re in – factor that exact number into your final number. Fact is, you’re losing money at a rate you cannot control. If you’re going to lose money then you might as well take a chance and invest.

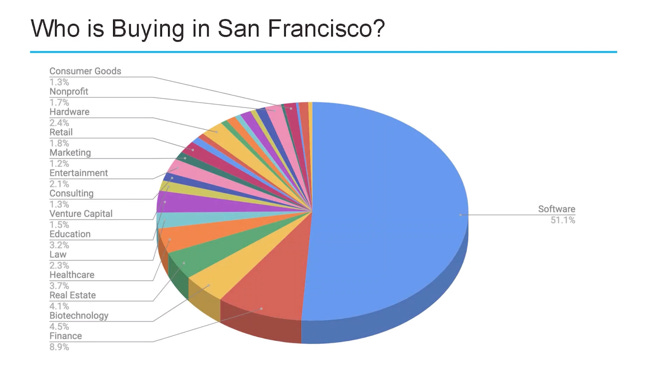

Investing at first seems like gambling, but what is more of a gamble is not investing and hoping that you’ll get rich. If you’re going to lose money anyway – then you might as well gain something from losing so that you could better yourself for the next opportunity. If you thought healthcare brings in the money – you’ll be sadly mistaken. If you thought lawyers make money – you’ll be sadly mistaken. The people who really make money are tech employees who opt to have their salary paid in Restrictive Stock Units. Restrictive Stock Units is exactly what it is – stocks. Technology stocks grow faster than any other Sector and as the stock appreciates, they are able to sell off their stock to buy whatever it is that they want. Basically, the stocks are growing 24/7 and the money is piling in every single time. What if the stock splits? Tech employees make even more money. They don’t even have to sell. They can control their tax bracket, and still outpace inflation and taxes. To give you a visual – this was the group that was buying one of the most expensive real estate in 2019.

(The Atlantic)

Healthcare: 3.7% / Software: 51.1%

Basically, we’re a drop in the bucket. We, as healthcare professionals, do not have ways to grow our money. We have to invest. It’s not about working hard, it’s about working smart. I hope this hits you differently. I hope this changes the way you think. We are doomed by inflation and taxes, and as more money gets printed, the more things will go up.

This is just the beginning.

Retire By Investing is on a mission to help others increase their free time through financial education. This substack does not provide financial advice of any kind. We do not sell or manage financial investments or vehicles. We are not licensed individuals and are not liable for any financial decisions you make. Please do your own due diligence and consult/seek your financial advisor regarding any decisions. Thank you. Have a great day!

Join us on our journey to help others by subscribing below!

If you liked this post from Retire By Investing, why not share it?

Thumbnail Pictures Provided By These Artists on Pexels.