Possible Buys

This is what we're looking into to rebuild our portfolio.

Current Positions will be on a different post.

GGAL - Yes

Technicals:

ATH, Weekly Inside candle, Sideways Action for 4 weeks with orderly pullback to test 50 SMA and trend pivot within rectangle.

Analysis:

Looking to see which direction this goes since we have some weakness breaking upward from the trendline. IF the stock actually goes down below to the 50 SMA then I'll be buying weakness from this point since this stock is at All time high (which eventually goes higher).

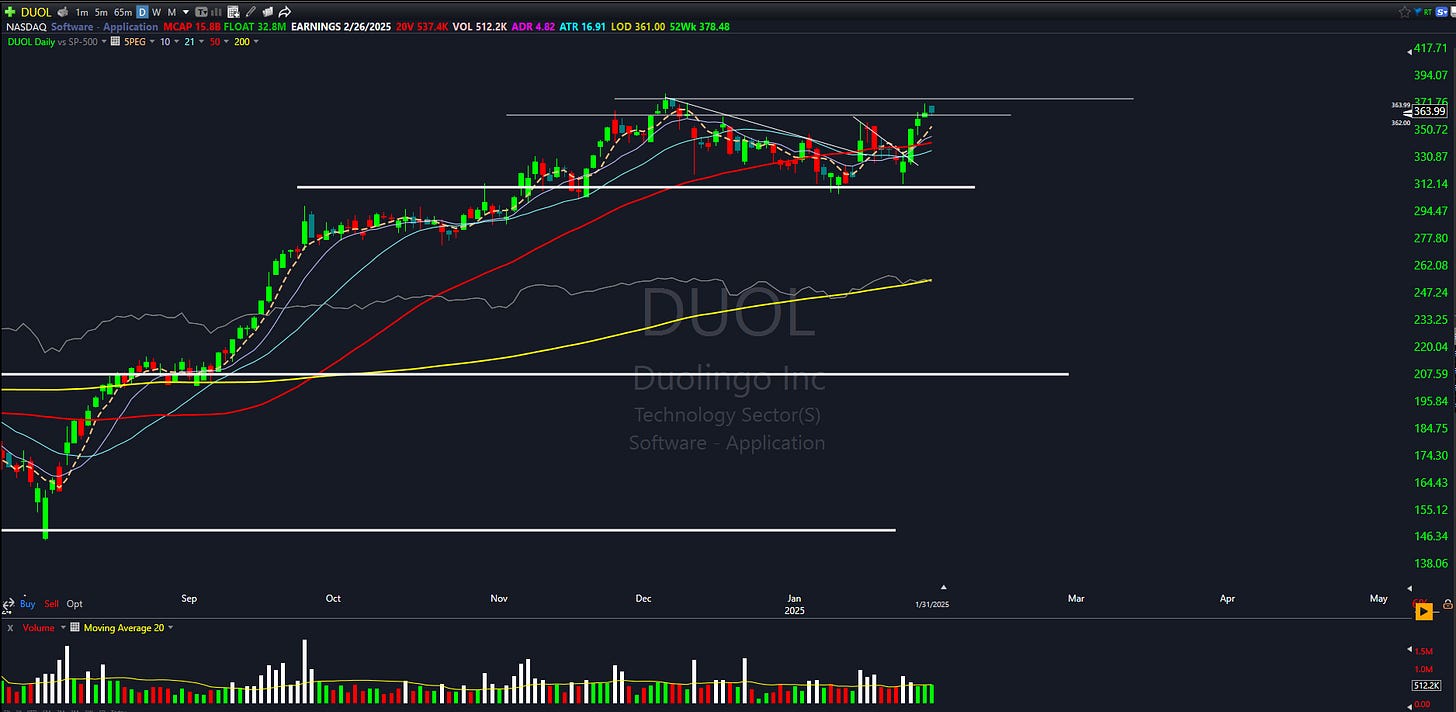

DUOL - Maybe

Technicals:

10 Weeks Sideways, ATH with two trend pivots. Bounce at a horizontal breakout level.

Analysis:

A bit extended, but could offer some really good risk reward. Waiting to see how we base at all time highs before actually making a moving. Want it to go sideways for a couple of days. If the market is red then watch how this stock reacts to news.

FUBO - Yes

Technicals:

Highest volume candle with a huge weekly downtrend break. Consolidating at the 10 SMA with a possible inverse head and shoulders on the 65 minute.

Analysis:

Small stock with pretty good rewards. Still considered a small cap since it's below 2 billion market cap. Will be watching to see if we can buy weakness with a stop near 3.50

SOFI - Maybe

Technicals:

Broke 52W High, but squatted, Support at 50 SMA, 10 Week sideways base.

Analysis:

Will need to see which way this breaks. If there's any type of weakness then I'll be looking to buy near the support candle of rectangle with a small starter again. If not then buying above and setting stop to 15.22 or 15.59 will be key, but depends on how the stock figures itself out this week.

LUNR

SATS - Yes

Technicals:

Golden Cross from before. 4 Months sideways base. Surfing 10 SMA. Orderly pullback. Inside Day.

Analysis:

Would love all the SMAs to catch up, but that's not always the case. This stock looks primed for the upside. We'll see what happens this week.

KULR - Maybe

Technicals:

Higher Low. Surfing the 50 SMA. Up/Near a horizontal support.

Analysis:

Could easily break from here. Just something to watch. Nothing to do. Other SMAS are pretty loose imo.

RBRK - Maybe

Technicals:

Higher Low. Surfing 5/10 SMA, but rejected at resistance.

Analysis:

Could easily reverse this week, but if it breaks out would like to take a starter and add later.

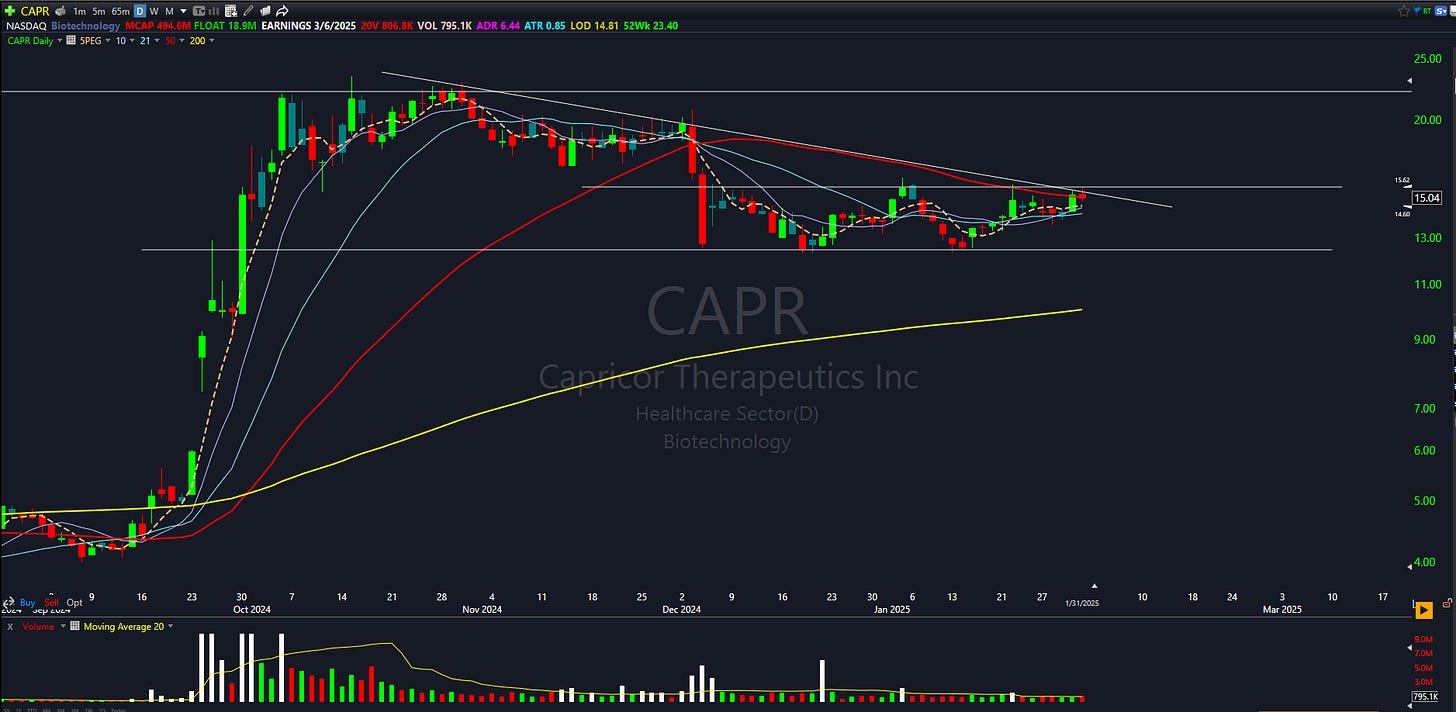

CAPR - Yes

Technicals: Inside Week. 16 Week Base. Up against a trendline. Top of Rectangle Mini base. Surfing 5/10/20 SMA.

Analysis: Buying if breaks above the 50 SMA. Stop would be around 13.50s.

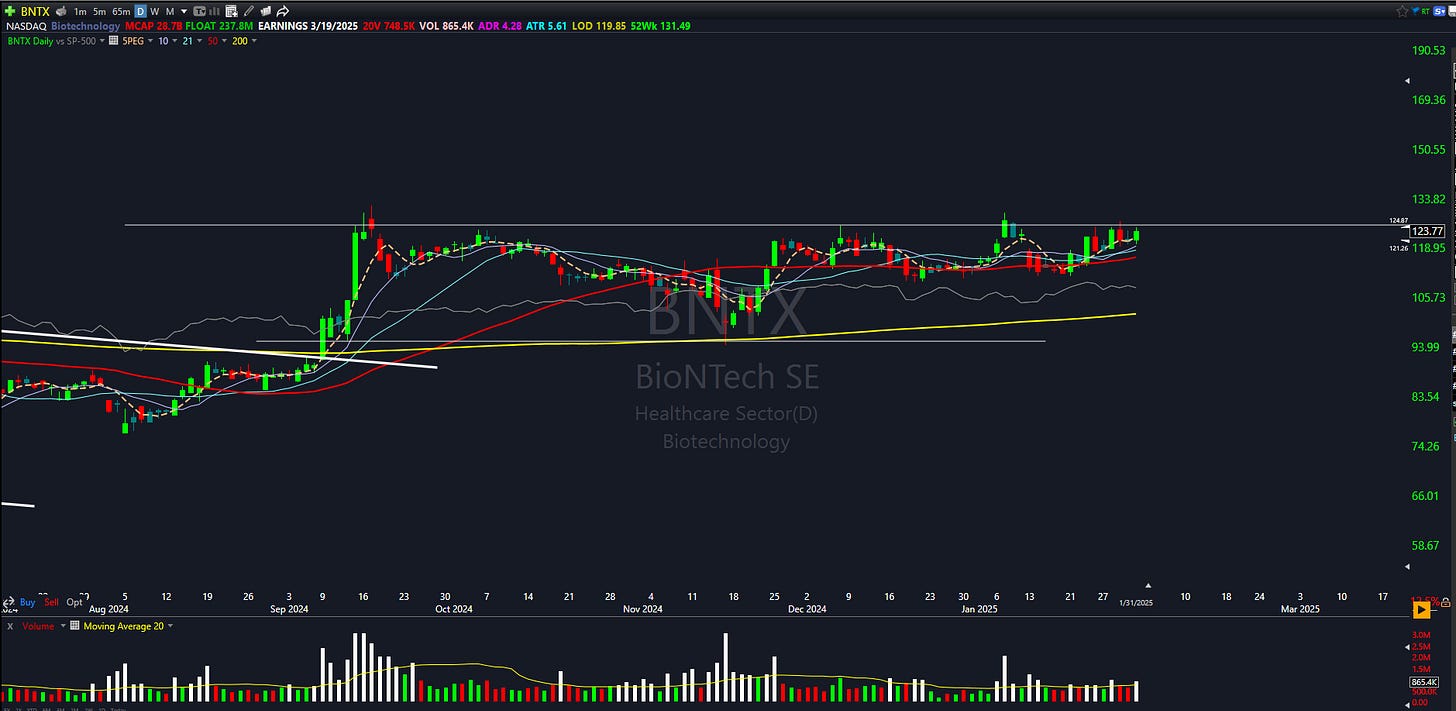

BNTX - Yes

Technicals:

23 Week Base. Above 200 SMA. Surfing 5/10/20/50

Analysis:

Stock has been acting right this whole time and been building out HL in a weekly base. Upside seems pretty likely on this stock.

EOSE = Yes (Eventually)

Technicals:

Surfing 20 SMA. Inside Day. Massive Weekly Double Bottom on the weekly with confirmation of break. Rejection at top of rectangle.

Analysis:

Waiting to see where this goes because it can go either way on this inside day. However for the future definitely want a position.

TSLA - Yes (Eventually)

Technicals:

Got Rejected by the 10/20 SMA. Above 5/50. Downtrend line possible breaking getting tested 3 times now.

Analysis:

Pretty weak against the market for the most part as other names have rallied, but we’re having an orderly consolidation. Need this to finally clear and set the stop to the PLOD (Use TSLL for more upside - watch your downside).

RKLB - Yes

Technicals:

Inside day. Pullback from ATH. Above the 20/50 SMA and could push higher. w

Analysis:

If the stock market starts to gap down I’ll be watching this for a possible position, but need to really see how it reacts to everything tomorrow.

PAYO - Yes

Technicals:

Above all SMAS. Testing the 5 SMA as asupport with a 2.9 Month base.

Analysis:

The range is definitely showing strength. Needs to clear the 11.30 level to even have a good chance to push out of the base.