Current Position Update.

Possible Entries?

WULF

Technicals:

Finding support at the 50 WMA, which is a 1 year DMA. At the pivot of the trendline. Highest Weekly volume that was accumulated by probably institutions this week.

Analysis:

Pretty cheap to actually get into this stock that has a pretty high ADR (volatility). This area offers the best risk to reward to get into, but it is up to you based on your position sizing.

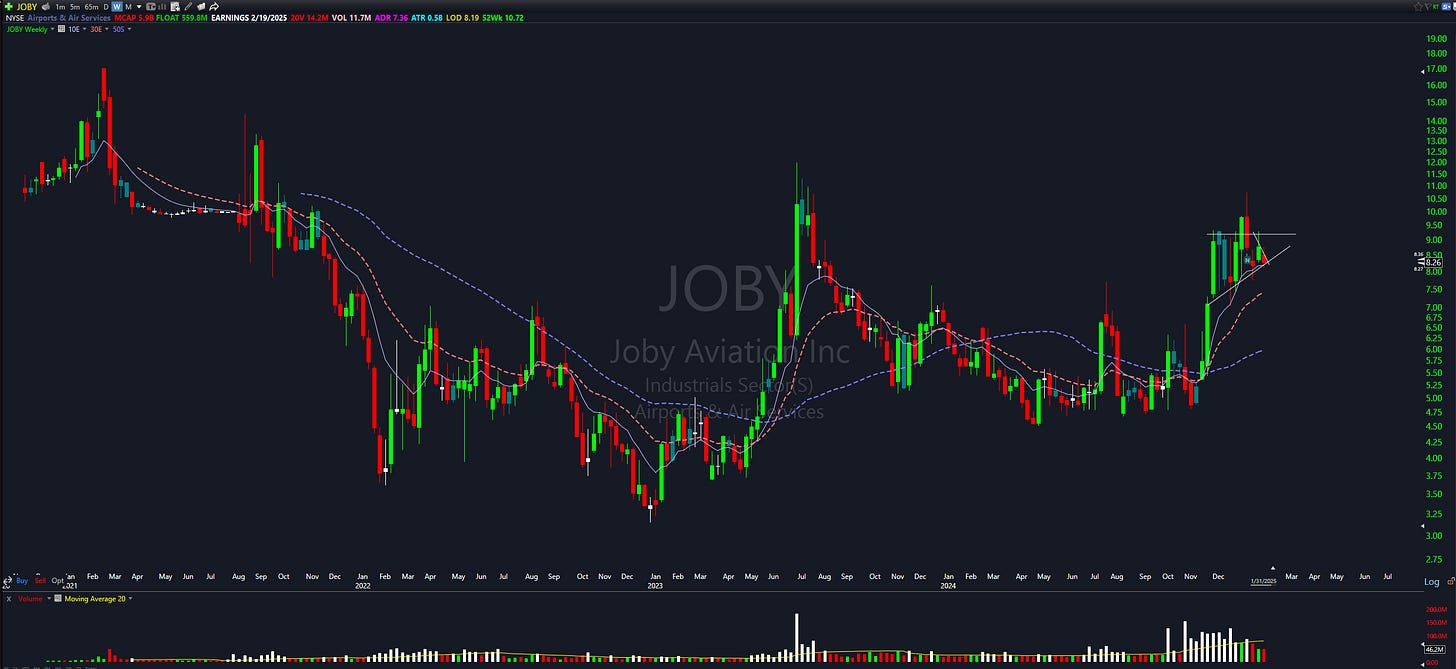

JOBY

Technicals:

Found Support at the 10 WMA. Weekly Low is 8.09. Ascending triangle pattern that can possibly break higher in the near future.

Analysis:

Industry is also leading with ACHR, but that’s a different ticker that is also in the space. Could break down further down and that would stop us out, but we’ll see what happens from there. Direction is still in a range, but has been HH and HL, but had our first LH, but HL.

FNMA

Technicals:

16 YEAR Rectangle. Not much to be said.

Analysis:

Honestly this is probably one of the best risk to reward investments because it is breaking a multi year base. We currently have 2 inside weeks, but we may test the 10 WMA or the the Thick Horizontal trendline. If it pulls back to 4.5 then that would be a really good entry. This is an OTC stock so there are no stops.

EQT

Technicals: 2 Year Rectangle. 10 WMA Support and flipped Resistance to Support.

Analysis: This would be a good time to buy, but would recommend a starter before putting a full position on.

RUM

Technicals:

Highest volume ever volume on weekly candle. Tested the 10 WMA Previously, but currently has a inside weekly candle.

Analysis:

Depending on the market an entry near the bottom of the rectangle is a better area to get in, but 11.73 we the previous Low for the week. You could get in, but don’t be surprised if you get stopped out quickly. Stock needs to base imo.

DEFTF

Technicals: 4 Year Rectangle at the top of the resistance line. 1.8Month Sideways base

Analysis: Anything from 2-3.5 dollars is a good area to get in IMO. Pretty low risk to reward.